There is no one-size-fits-all and whichever you make a decision on, make certain the deductible amount best fits your situation. Does Insurance Coverage Pay Back Your Deductible?

auto insurance insurance company low-cost auto insurance affordable auto insurance

auto insurance insurance company low-cost auto insurance affordable auto insurance

low-cost auto insurance cheaper auto insurance car insurance insurance

low-cost auto insurance cheaper auto insurance car insurance insurance

If you remain in the marketplace for a brand-new vehicle insurance plan, it is necessary to find the best insurance coverage and deductible for you. Eventually, how much protection you have and what you pay out-of-pocket are based upon the type of insurance coverage you obtain and the automobile insurance deductible you pick. It can be tempting to pick the highest possible insurance deductible as that often results in a reduced monthly premium. cars.

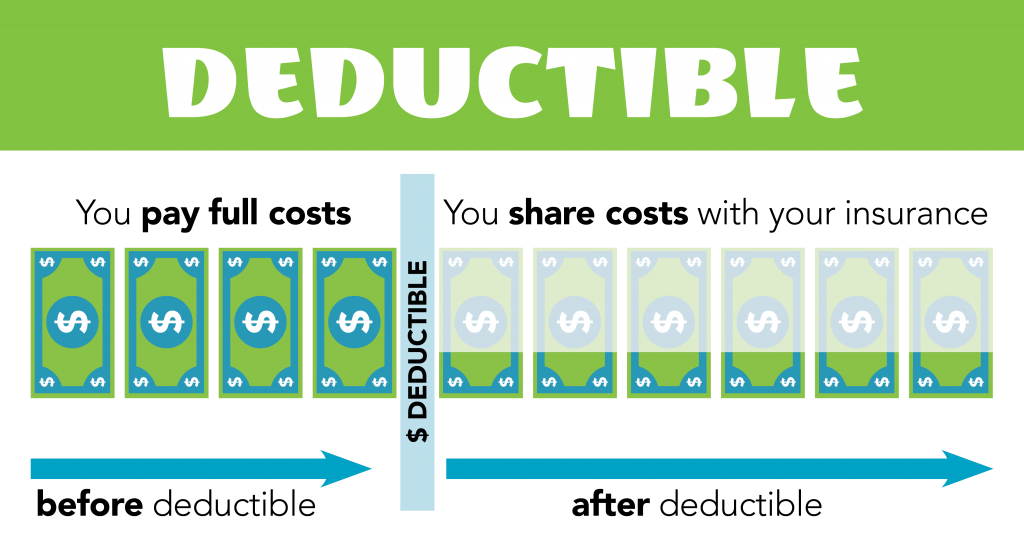

Locate out what to take into consideration when choosing a vehicle insurance policy deductible for your requirements, budget, and way of life. A vehicle insurance Homepage coverage deductible refers to the total amount a policyholder pays out-of-pocket prior to the insurance coverage covers a certified incident.

What makes auto insurance coverage various from various other sorts of insurance is that you are in charge of paying the insurance deductible each time you file a case. How does a cars and truck insurance coverage deductible work? If you get into a car crash or other kind of occurrence covered under your plan, you'll require to file a case. trucks.

You may also pay the deductible directly to the repair work shop fixing your automobile. Your cars and truck insurance deductible is your duty and needs to be paid prior to your insurance company covers the rest. What are deductibles based off of? As a customer, you can normally select a greater insurance deductible and also score a lower car insurance premium (low cost).

If any kind of damage or repair work are much less than the cost of your insurance deductible, then it's not worth filing a case - money. On the other hand, if you select a lower vehicle insurance deductible in between $100 as well as $500, the probability of you submitting an insurance claim goes up (low cost auto). That implies you'll likely pay a higher regular monthly costs as well as be considered even more of a danger to your insurance service provider.

The smart Trick of High-deductible Car Insurance (Updated June 2022) - Insurify That Nobody is Discussing

When do you pay the insurance deductible for vehicle insurance? You don't need to pay your car insurance policy deductible when choosing a vehicle insurance plan. Instead, you pay your automobile insurance policy costs. You have to pay your auto insurance coverage deductible when you make an insurance claim. The automobile insurance deductible can be payable to either your service center or your insurance provider, relying on the quantity, your plan, and your provider's basic deductible policy. insurance affordable.

Keep in mind, inevitably, paying your insurance deductible is up to you (car insurance). If you prefer to not submit a case, you do not have to pay your insurance deductible, however you will certainly be accountable for the whole expense of your fixing. What are the different sorts of auto insurance deductibles? When you pick a car insurance plan, you register for a specific kind of protection that can assist in certain scenarios.

If your vehicle obtains damaged in a freak hailstorm or hit by a deer, or ends up being taken, extensive insurance coverage will certainly come to the rescue. This type of protection is normally offered in tandem with accident insurance policy.

This type of coverage assists cover the expense of repairs or any type of required substitutes if there's a case (business insurance). In the occasion you obtain into a mishap with an uninsured vehicle driver or one with limited protection, this kind of insurance can assist cover expenses.

suvs low cost insurance companies low-cost auto insurance

suvs low cost insurance companies low-cost auto insurance

This may not be provided in every state or by every insurance supplier. Injury protection (PIP) Medical prices are a concern for numerous people. Accident defense insurance can help cover clinical prices after an accident despite who is located at-fault - cheaper auto insurance. Some states like New Jersey need this kind of insurance policy as it's considered a "no fault" state.

If you pick a lower cars and truck insurance deductible quantity, it's likely your costs will be higher. While you're paying more currently, if something occurs down the line as well as you get involved in a mishap, you'll pay less out-of-pocket after that. Your insurance deductible quantity ought to be something you feel comfortable paying or have simple accessibility to in an emergency fund, or as a last resource, a credit line.

3 Simple Techniques For Auto Insurance Claims Faq - Amica

As an example, if you choose obligation-only that covers damage and injury expenses for the various other motorist if you're at fault. credit. On the other hand, extensive as well as accident insurance can cover mishaps, burglary, and weather occasions that can appear of nowhere. You can pick the deductible amount for every sort of coverage, so if you assume you are a safe motorist, it might make feeling to have a greater crash insurance deductible (where you can commonly stop an accident) versus detailed (where the occasions are normally out of our control).

cheap car insurance company prices affordable car insurance

cheap car insurance company prices affordable car insurance

That implies considering your risk levels, demands, financial resources, and also more. You likewise wish to make sure you have the appropriate coverage to secure yourself in various situations. And also if you don't drive significantly? You can pay much less with pay-per-mile car insurance coverage with Metromile. If you're still paying for miles you aren't driving, it's time to rethink your vehicle insurance policy coverage.

There are a couple of points to consider when selecting your deductibles, such as your budget, the worth of your car, just how much you have in cost savings that you can place toward auto repair services as well as the likelihood that you'll require to make a claim (business insurance). Instance, If you have an older automobile with relatively reduced worth, you might intend to select a high insurance deductible in order to maintain your premiums lower.